You are here: Home1 / Exclusive Strategies

Weakness followed by a break down in parts of the General Markets ( The TRAN & RUT) was reported here by me over a week ago. Over time, we gradually saw improvement, so that is what was also reported toward the end of last week and in the weekend report. These area would need to be monitored continually. Well, Monday we saw signs of healing, so we need to address that as a starting point.

.

RUT - On March 22, the Russell 2000 lost the 50 sma and broke below the prior low. This is a bad sign and needed to be monitored. As this was taking place, the Transports were showing signs of weakness too, so these areas were to be reported on daily.

TRAN - The Transports were also breaking down as noted on March 20

TRAN -A week later the Tran stayed below the 50sma, so this is a concern and caution was warranted.

TRAN - I did point out a bullish possibility, but until the 50sma is recovered, I would be staying away from the Transports, and I would remain cautious in the General Markets.

Read More

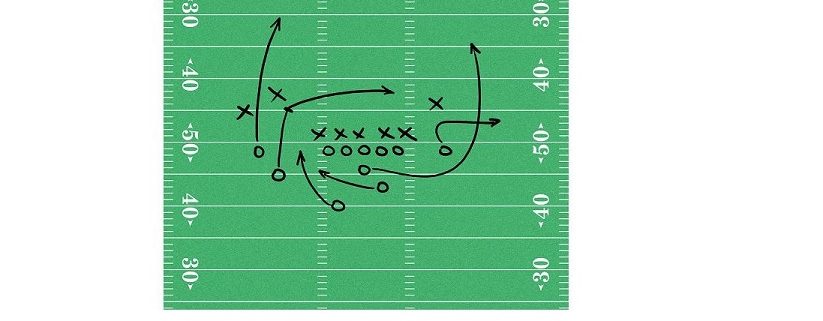

Read MoreIt doesn't matter if it is a Chess Game, a Football, Baseball, Basketball game , business planning ,or the Stock Markets- I have never known a winning team that did not think ahead and have some kind of a game plan. That's what Fridays report is going to discuss with the Precious Metals Sector...

Read MoreWith the current market set ups, we have seen some choppiness. I raised my stops and got stopped out of a few positions, and I may just strike that balance between cash & positions until things settle down a bit. Let's take a look at the markets.

.

SPX - The SPX lost the 10sma again and the MACD crossed down, and this would normally look a bit more bearish than bullish . Last week I took a position in the SOXS, but I'm going to show you why I decided to close it for now.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More