Oil – Buy the Expected Dip

OIL

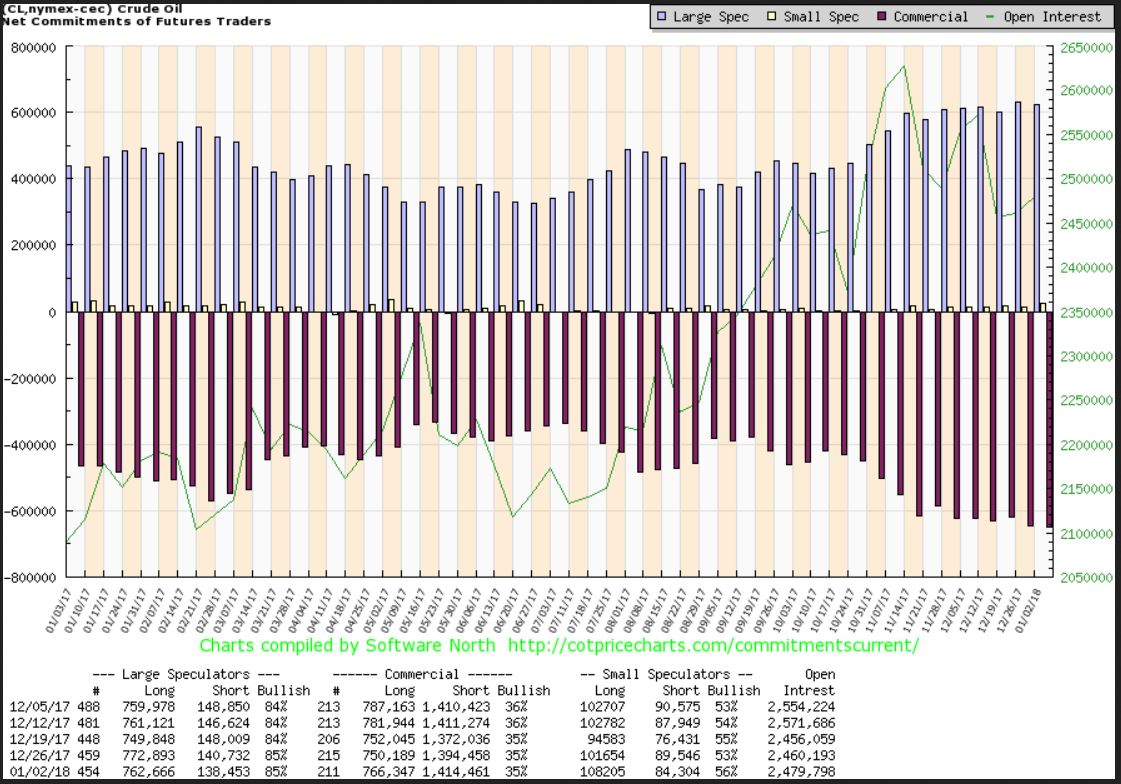

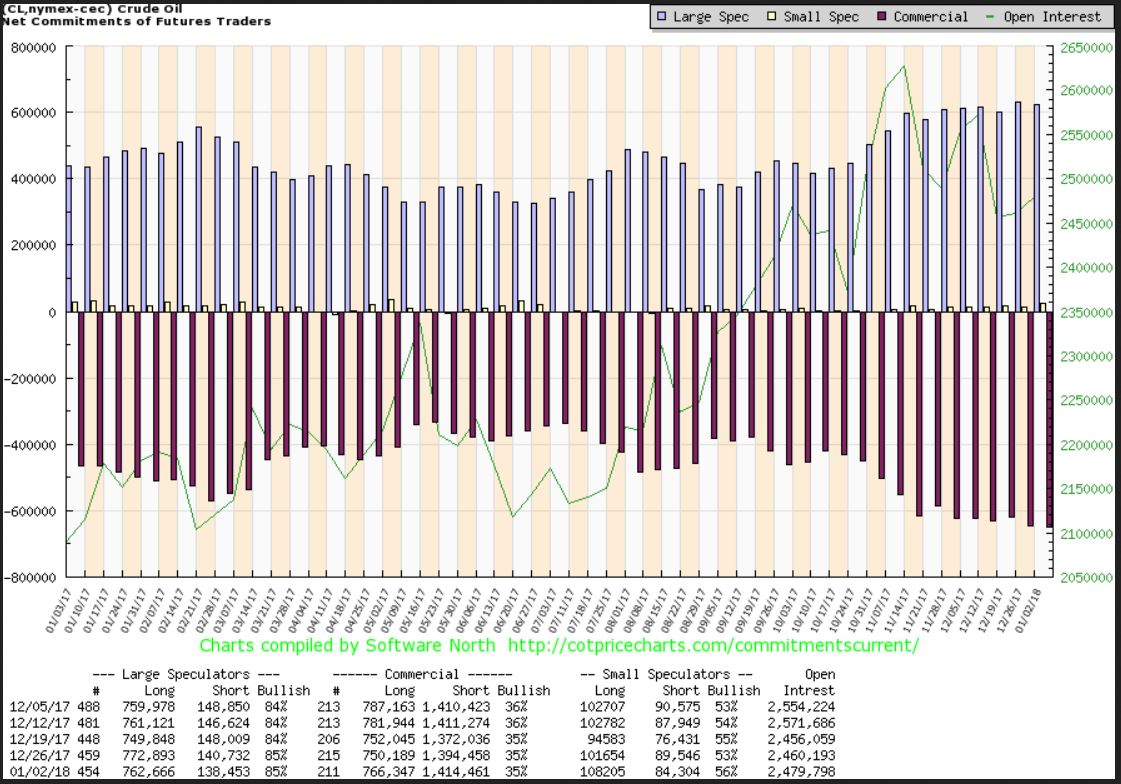

OIL's C.O.T. - The shorts by 'Smart Money' increased again. They are determined to ride a drop in Oil prices, though Oil has been bullish in recent weeks.

Read More

Read More Read More

Read More Read More

Read More

Read More

Read More Read More

Read More Read More

Read More.

.

.

.

.

.

.

.

.

.

.

Read More

Read Moreaccelerator diet pills goji berry diet pills ultra 90 diet pills keto meal replacement bar top weight loss diet pills for thyroid patients where to buy t lite diet pills keto friendly thickener diet fuel diet pills peanuts keto friendly rite aid diet pills that work envy diet pills diet pills for breastfeeding moms belique diet pills perfect slim weight loss pills calories in a bottle of white wine