You are here: Home1 / Exclusive Strategies

It certainly looks as though Oil has entered the capitulation phase of a sell off into an ICL, and a low is very near. I want to discuss that as a future buy opportunity in this report, but first we'll do a market review. Just to reiterate: In just about every sector, Trading remains very choppy. That can be a bit frustrating or even a bit damaging if position size isn't kept small, stops aren't honored, etc. The sidelines are not a bad place to be until the dust settles a bit.

.

SPX - Rejected at the 50 sma on a bounce, so far this peaked on day 7. We now have a possible inverse H&S, but the open gap below could draw price in for a gap fill.

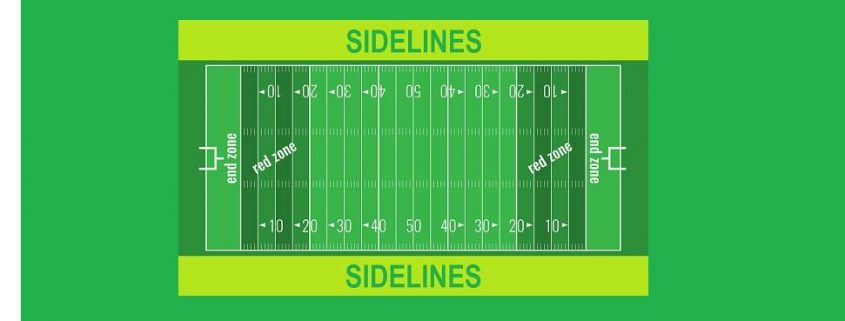

Read MoreThe Stock Market involves real money, so it's by no means considered just a 'game', but similar to many games, we have a few choices when we take a position(s). If, over time, we find that things are getting a little rough ( the markets may get choppy for example, or players may get banged up), we still have choices.

3 basic choices are:

1. We can exit the playing field (sell) and head for the sidelines to avoid all of the choppiness.

2. We can stay in the play until we get 'stopped out' or are rewarded with a move higher

3. Just wait on the sidelines and see how the game plays out for a bit as a spectator, and look for a better time to enter

.

Read More

Scroll to top