You are here: Home1 / Exclusive Strategies

One would expect a light volume holiday trading week, but so far many of the charts that I looked at have normal or average volume. Maybe it will lighten up each day, but let's take a look at what trading took place after the weekend report.

.

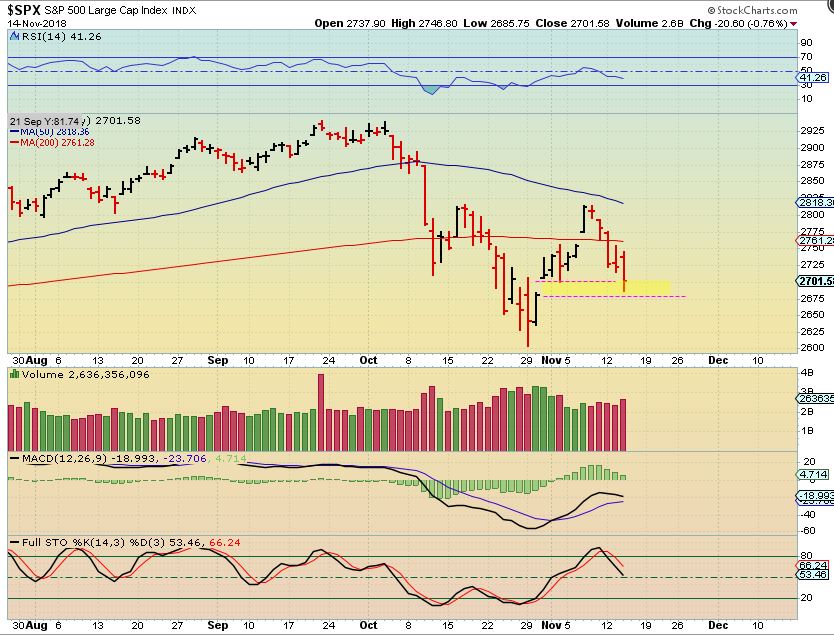

SPX - The markets have been choppy and instead of that inverse H&S pattern breaking back above the 200 sma again, Monday the Markets dropped.

I used this chart in the weekend report along with the increasingly ugly charts of FB, GOOG, NVDA, and even the IWMs lack of strength, to show the current weakness. I warned again that if we don't see strength soon, we may see an a-b-c drop that looks like this on the General Markets Weekly Charts.

Read More

Read MoreAs time moves forward, we begin to see the moves that we anticipated in various sectors, as they begin rising out of the recent lows. Let's get updated on our Big Picture expectations...

.

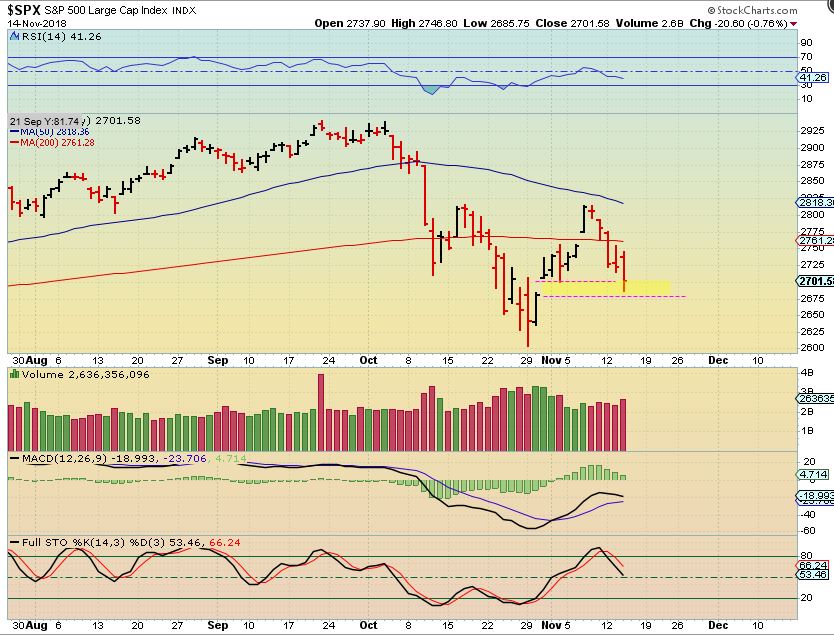

SPX WEEKLY #1 - We see that price has moved to resistance, please read the chart.

Read More

Read MoreJust a reminder : Today is the last trading day of the week, and next week will be a holiday shortened trading week in the U.S., so let's see where the markets stand and enjoy our Friday of trading!

,

Note: we'll see how 'earnings' affect the markets going forward, but NVDA released earnings after the bell, and got crushed, down over $33 or 16%. We will discuss that with the NASDAQ too.

.

SPX - Wednesday we had a gap fill and a bounce into the close. We need a bigger sign of strength than that, so we'd see if Thursdays trading could show some strength...

SPX - Markets sold off to a new low on Thursday morning, and then put in a nice reversal. It overtook more than 1/2 of the prior days candle, so you could add to positions on a day like that, with a tight stop at the lows. Our inverse H&S remains in tact, let's see if this can power higher.

Read More

Read More

Scroll to top

Read More

Read More Read More

Read More

Read More

Read More