A large part of my weekend report was directed to The USD, Gold, Silver, & the Miners. We caught the lows in December and have been investing in various Miners (& JNUG/NUGT) since even before Mid December. In the daily reports I discuss various bullish set ups and buying opportunities, but each weekend I often take a step back and give it a good ‘Big Picture View’.

I want to share some of this weekends report here. Things are playing out exactly as I have been thinking they would, and this is a good time to share some thoughts about it with you here. Thanks for checking in, and enjoy…

USD

MY USD CHART FROM SEPTEMBER – If you have been with me for a while, then you know that a break down in the USD is exactly what I have been expecting around the end of 2017. The USD broke below the 200 week MA and after a bounce I expected it to roll over. This would be a catalyst for the Gold Bull to continue running higher.

USD CURRENTLY – The USD did bounce, and then dropped below the ICL/YCL from early September on Friday. THAT is a Failed Intermediate Cycle and can lead to much lower prices over time. This is a weak USD, and that bodes well for Precious Metals.

USD DAILY – about 2 weeks ago I drew the USD as having a dcl on day 24. If this just rolled over with a day 5 peak & this is day 8, then we have a ways to go on the down side. It also MIGHT be an extended daily cycle and the dcl is not day 24, it would still be ahead. Either way, the USD is showing weakness.

As December rolled around and GOLD & SILVER were selling off, I noted that several Miners looked rather bullish despite the selling. Gold & Silver stocks looked to be ‘On Sale’, and I posted charts of several bullish set ups in Miners.

GOLD DEC 7th – I was still being cautious in early December before the FOMC MTG, but we were hunting for that next important ICL (low) to show up soon.

GOLD DEC 7th – I was still being cautious in early December before the FOMC MTG, but we were hunting for that next important ICL (low) to show up soon.

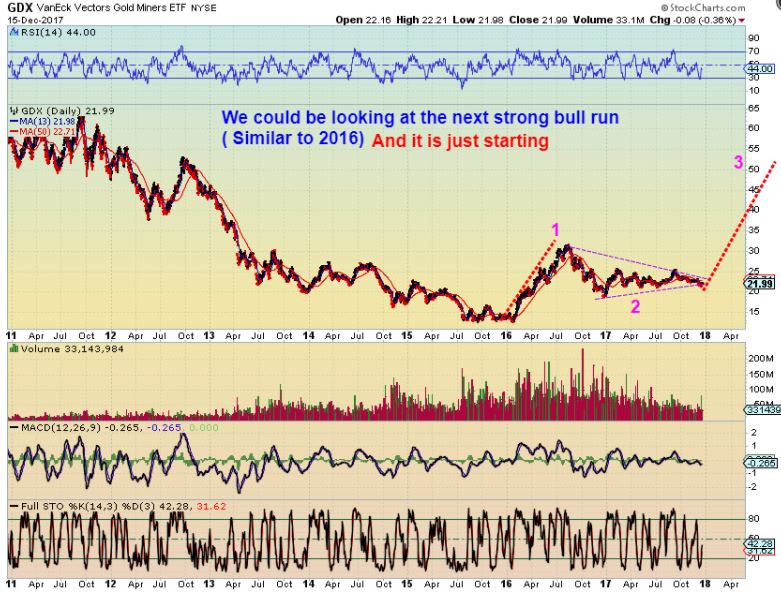

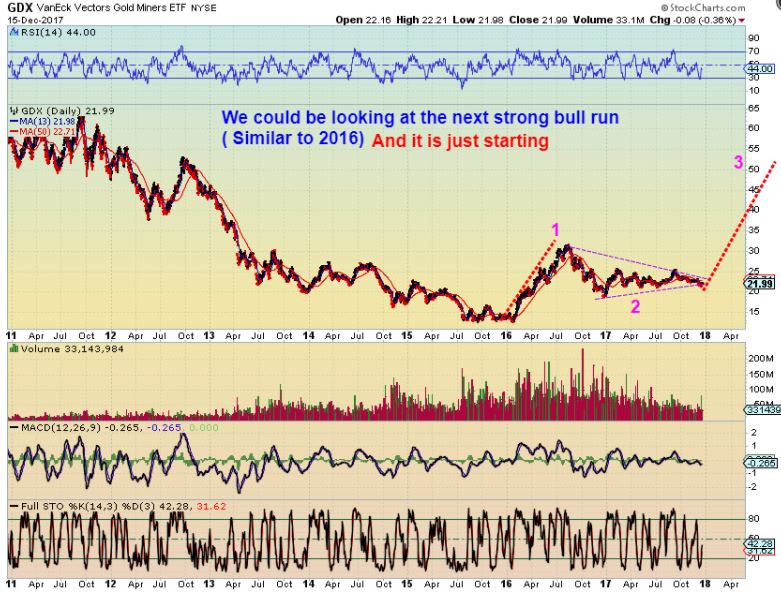

GDX DEC 15th Daily – To give my readers a look at the risk / reward, I posted a few charts like this one below. Even if you were still ‘cautious’, you could start small, use a stop, and ‘add’ to position as this proves itself. I mentioned that I bought JNUG after that FOMC meeting.

GOLD – So far the run left many behind that have been waiting to ‘buy the pull backs’. What pull backs? Timing-wise, we are getting close to a seeing a ‘pull back’ into the next daily cycle low however. A normal dip in a bullish run.

GOLD – We are staying focused on the big picture, and this intermediate cycle has not peaked yet.

Higher Cyclical lows ( ICLs) in Purple for 2017 are bullish. This 5 yr chart actually looks like a Giant base in recovery mode.

SILVER – Silver is on the verge of a major break out, and when silver & silver stocks run, they usually run QUICKLY.

SILVER – Look at 2003 when Silver got above the 200 weekly sma, buyers loved it. We seem to be at that point again.

Last week using this & other charts, I discussed buying a variety of Silver stocks, because they popped on Jan 10th while Silver was down. Did you notice that when it happened?

GDX – I see this as a 1/2 cycle low and we did NOT sell as this dipped. Why not?

GDX CHART FROM JAN 8th – I had been pointing out ( red boxes) a possible ‘stall’ or ‘dip’ as a guide for my readers, comparing it to the one in August. We were expecting this recent choppiness.

GDX CURRENTLY – This dip still looks similar to what we had in July, and you can see that the 2nd rush higher was better than the first. We may not go straight up from here, that is just how bulls will try to kick you off.

JNUG – I have owned JNUG since the 13th of December. I also added when the ICL was confirmed. I expect higher price over time regardless of these short term wiggles.

GDX – Even a smaller run similar to the Dec 2016 – Feb 2017 run would be a bit longer than what we’ve already seen in this run.

GDX WKLY – OUR BIGGER PICTURE POSSIBILITY – Is that a multiyear inverse H&S? This is NOT out of the question if we have a 6 month run like the 2016 run.

GG – GG went from weak and ugly in Decembers sell off , scaring buyers away. Then it became very strong. If you were ‘expecting’ the lows then too, you may hve caught this run.

CDE – Jan 2 was a buy for CDE under $8, as it was breaking above the 50sma.

The BIG PICTURE FOR CDE – What if we get another run like the 2016 run? This summer if CDE is at $22, we will all wish we bought it now at $7 or $8.

I still have people telling me “Miners are in a bear market, it is too risky! These could sell off at any time. “. I understand that people have been burned by the miners at times, but ‘timing’ is everything. Cycles can help you to know when it is safer to enter & even exit. We have made Great gains at ICl’s and we caught the entire 2016 Run higher.

Not only that, but take a look at something that I also point out to my readers using various Miners charts. We’ll use IAG for this example:

IAG WKLY – Is this stock still in a bear market sell off ? I don’t think so at all. IAG is back at the 2016 highs, and I see a bullish Cup & Handle pattern.

Conclusion for Miners:

Some miners have had excellent runs higher, but they may be getting extended at this point. Some are due for a pullback, while others may be just getting going, so I don’t just encourage jumping into just any ole Miner right now. I usually have lower risk set ups in the weekday reports as they present themselves, often after a small pull back.

Also, using ‘cycle timing’ Gold will be coming due for a drop into a daily cycle low soon enough. Would you like a 2nd set of eyes to help you to navigate through the coming weeks or months ahead? I will be covering this sector in the daily reports, so as things continue to unfold, you will be informed. Why not sign up for a month or a quarter and make money with us here at Chartfreak? We also have a ‘comments’ section or chat section where many experienced traders share ideas.

.

This portion of my weekend report is only a fraction of the weekend report that was posted in the ‘Premium Members’ section. That one actually consists of 45 charts this weekend, including individual Miners, SPX, OIL, NATGAS, and more! It may be worth trying it out for at least a month, and see if my analysis combined with your own trading experience or views, can help you to become more profitable. 🙂

To sign up, click here

CLICK HERE

Thanks for checking us out!

~ALEX

WEEKEND REPORT

January 17th – Expectations

January 17th – Expectations

Scroll to top

GOLD DEC 7th – I was still being cautious in early December before the FOMC MTG, but we were hunting for that next important ICL (low) to show up soon.

GOLD DEC 7th – I was still being cautious in early December before the FOMC MTG, but we were hunting for that next important ICL (low) to show up soon.

Yup, the marijuana plays are sweetly reversing. I started THCX.V in high 3s today

Canadian silver stocks today’s close:

MUX +4.70%

great panther +3.91%

First majestic +5.21%

endeavour +3.66%

Fortuna -0.30%.

Let’s keep this going tomorrow USA!!

I sure would be excited to wake up and see AG and MUX up like that!

https://uploads.disquscdn.com/images/8c2ca871a6c58ddcbb34b94591d4dc7fc0a9153832b54d0128da829e9ca7d959.jpg

NAK weekly chart attached. Technically speaking price might bounce off lower trend line soon? It may have closed just below last week but could be a shake out? RSI very low

Double bottom last week at $1.63 I think. Up slightly now, waiting for ignition.

Thanks Bill. I see the double bottom. Let’s hope for blast off

THCX.V (the Hydropotthecary Corp), HYYDF on the OTC, is a grower in Quebec who will likely get a significant supply nod from the Quebec and now has a former government official as VP

government.http://ottawacitizen.com/news/local-news/former-b-c-health-minister-terry-lake-named-vp-of-gatineau-medical-marijuana-company

“bad” news abound on cryptos this morning, yet still holding above the Dec lows. “If they can hold here…”

VALE got a downgrade this morning.

News out this morning on MYDX that they are starting clinical trials in Israel. PURA stock dividend/spin…? I think it is good news.

MARA brought in an accounting firm to handle a dispute with their old one…? CNBX…long report detailing BIZ [promising] and warning of $ need…?

Confusing morning for me so far!

Where is everyone?!

here!

Me too..off today..Winter storm in Houston? That’s what they say.

Pshew! Thought my link to Chartfreak was broken! LOL…I guess I am an addict!

hi J…is that normal for round there?

No…… but nothing is ever normal around here…:)

lol ain’t that the truth

My friends in ‘Longview’ just sent a picture. They are from New England, so they handle snow well, but he said that the place is ‘shut down’, and it only looked like an inch of snow from the picture 🙂

You know we get this sleet/snow/ice thing every few years. It just seems there is memory erasure in between episodes, folks just run off icy roads. Its like Deja-vu all over again. 🙂

Pshew…see below! LOL

Tuesday, I thought there would be a new report, but someone is slacking.

That comment may provoke a response! LOL

I guess you were right! Someone got up on the wrong side of the bed……….#yPmuRg

Yes, yesterdays action was so compelling in the US markets, BUT- I thought that you could figure it out for yourself. lol

Here is a quick summary of the US Market action yesterday 🙂

…………………………………………………………………………………………

LOL

shovel snow

O…poor you! [from sunny, but cold for us, Florida!]

Chopping firewood. All done now…for a couple days.

It’s showtime folks

Liking AG, AXU, BTG, and MGXMF today.

Well look at ‘AG” – I havent heard people liking AG in a while 🙂

MGXMF has been very good to me too.

Wish NSRPF would get over it and get a move on. lol

huge MJ start!

having said that after quick look at charts, I have to fade the rally….looks like it is just banging up against the 10 day in most cases…..there will be more ops!!!

HUGE

ATTBF is up 30% OGRMF is up 60 cents.

From Boom to Bust to Boom !

Is this a real change of direction for the sector?

Maybe we will get a report on MJ sector Tomorrow? 🙂

Hi…glad you are here! Hope you are feeling better.

Thanks, I feel much better, but I went couldnt sleep last night – woke up at 6 a.m. , went back to bed and overslept.

Need to get my routine back 🙂

I will get back aboard the MJs at the trendlines but wow really nice did not expect the rally this AM – was there news in Canada last 3 days?

Dumped est of my MARA with slight profit. Love my CNBX…guess the report was taken favorably.

what report Nancy?

Form 10Q for Nov. 30th….long, but worth a read when you see what promising projects they are working on, but scary because it has the warning of need $.

great thanks! Yeah everyone will need $….so need to take that into account….I think when this at least retests lows it is a buy….not yet for me 😉

AG- First Majestic- the market seems to like todays guidance for 2018. Guidance doesn’t include proposed Primero transaction.

Bring on the upgrade to neutral BMO… and when San Dimas closes- the buy recommendation!

Just scroll up to the last chart in this report- I’ll give it a buy recommendation – lol

AG my largest silver 🙂

I am holding my cryptos…this looks close to a low…….

I am watching ‘Bitcoin’ basically and the only problem I have it …

That low in December looked like the lows, now if it is broken, I wonder if THE ICL type lows become this new low in January,

or did BITCOIN break the ICL in December and become a ‘failed’ cycle – and a parabola occurred.

I still own MARA, but it is a tough call at this point.

agree tough call….I am guessing we hold the lows, or break them and bounce back….but if things don’t cooperate by later this week I will exit

I replied to myself at the same time as you 🙂

I’m watching it closer now- due to the gap

Actually

There is a very big gap below on MARA, and Mara is pretty close to where I bought it.

Maybe I should just step off instead of ‘Wait & See’ – jump back in if things flip upside.

The downside risk of filling that gap is pretty big on the loss area, though it is a small position.

yes I see the gap, that is the risk – but it will be a buy area in my op…..real tough to call tho….RIOT has same gap….everything looks on edge

What about that gap at 34 on GDXJ? hmmm….

bot CDE here….

Pleased to be back in CNBX this morning.

Good morning to all. The weed stocks via MJX didn´t get to oversold before taking off without me, so will wait patiently. I am not adding to PM miners yet, but am starting to build a position in NXE (uranium) for a long term hold, on this pullback.

NSRPF – No recommendation , just an observation.

VERY HIGH capitulation type lows in NSRPF are being ‘tested’ on very light volume.

This USUALLY indicates that sellers are drying up and this often leads to at least a good bounce ( barring any future bad news that causes another round of heavy selling)

refresh

https://uploads.disquscdn.com/images/dd01f3227d7d7f795ecd6687ee51c2d392ecb6d837e7859de87bf45ebd58a32a.jpg

Looks like the 13sma was support for a lot of MJ stocks

MUX trying to get above it´s 200 day MA again.

KSHB just won’t stop