Archive for month: October, 2015

Week in review, lets see how things are growing...

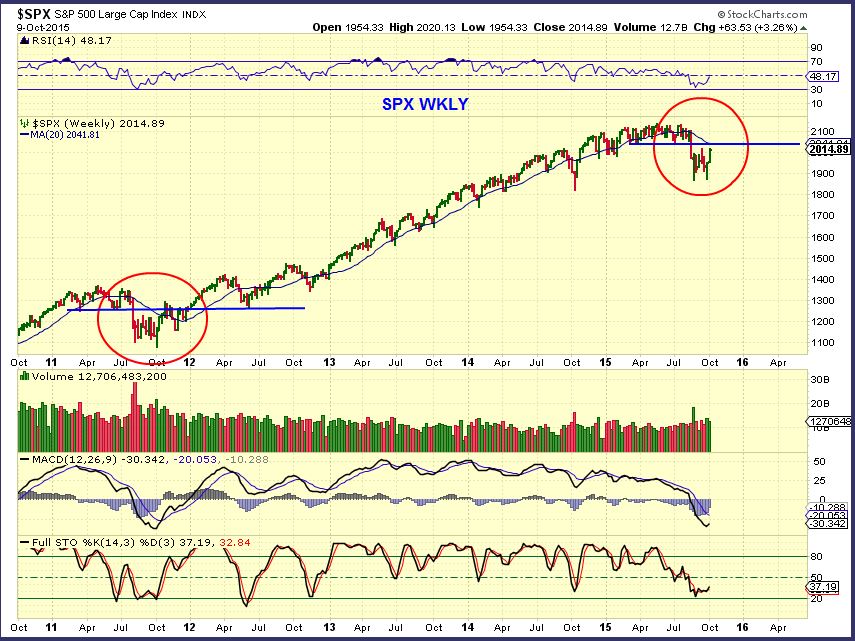

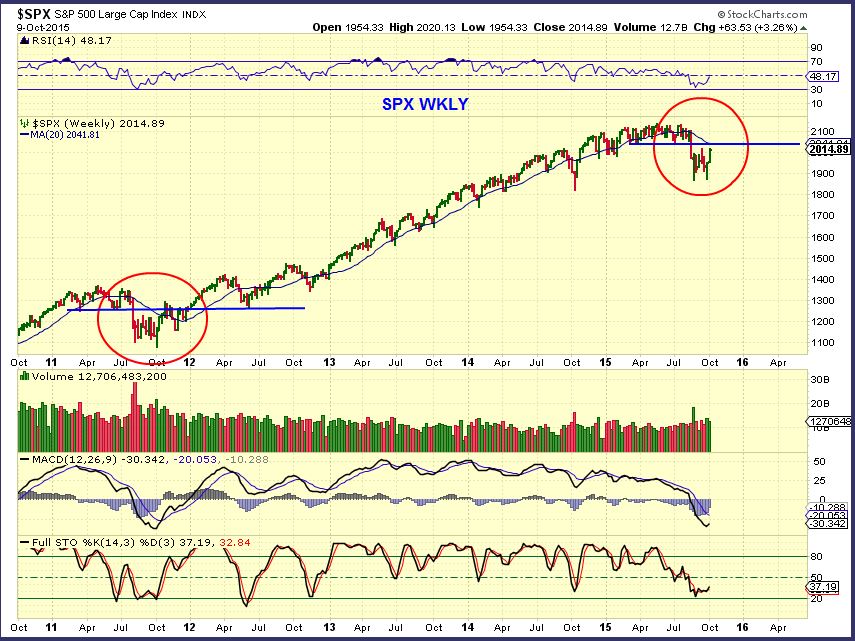

SPX - Are we setting up for a back test and rejection? Or are we about to break through?

Lets look at some clues...

Read MoreI'll tell you whats up. The SPX , DJIA, NASDAQ, IBB, IWM, SOX, USD, OIL, OIH, XLE, SILVER, all closed higher and GOLD & GDX were for up for most of the day too. Yes, it was Green just about everywhere except for NATGAS. Lets discuss the points of interest.

This is basically what the SPX, NASDAQ, DJIA, IWM, etc. all looked like.

Read More

Read MoreSome of the 'set ups' mentioned last week are running now, other stocks that ran recently have pulled back and may be currently setting up to make another run higher. Lets discuss this after our market review. Something interesting may be happening there too.

From yesterdays report, we saw this in a few sectors

Now we are getting a little follow through to the downside

This caught my eye however...

Read MoreThe markets didn't move in quantum leaps yesterday, but there was a little change in how we may want to view things. Lets discuss what stayed the same and what may have changed.

IWM - We saw a reversal at a point of resistance

Read More

Read MoreI was a little surprised to see the dollar down and also see the $CRB, $GDX, and $OIL down too. They've all had nice moves out of their lows, and now it looks like it may be the moment of truth. Time to see if it was just another bear market rally or could it be the start of something more?

WTIC - From the weekend report. I had been expecting the 200sma to offer resistance and a quick dip lower.

There are a couple of other factors in play that I am watching too at this point.

Read MoreEvery now and then I like to step back for the weekend report and take a look at the Big Picture. I have been reporting for months that I see big picture changes in many sectors starting to take shape. Lets see if they are advancing or falling apart.

The SPX is approaching resistance. Will it halt the rise, or possibly just give it a pause like we saw in 2011?

Lets look for some clues...

Read MoreThe saying , "What goes up must come down" is true within Bull and Bear markets. Lets take a look at what is going up and what is likely to come back down, keeping in mind that the FED MINUTES are to be released later today.

.

I drew this last week to show that I expected the SPX to move up to the purple line

Read More

Read MoreThe Oil and Energy Stocks were leading the way with their recent bullish activity. As pointed out yesterday, the XLE broke out from a downtrend and was probably signaling that OIL was about to follow. Quite a few of the stocks were up 20 - 30% in 1 day yesterday! We'll discuss more about the potential here in a moment, but first lets review the rest of the market action.

SPX- Resistance is overhead. A pause below the 50 sma may be building energy to break higher, and a break above could see buyers rush in and push it higher.

Why is it possible that this resistance wont hold it back?...

Read More

Scroll to top

Read More

Read More

Read More

Read More

Read More

Read More