Archive for month: April, 2015

SO far our ENERGY picks have been right on target. What I was looking for in Natgas for the past few weeks has also taken place perfectly. Gold & Miners? We'll discuss that too, but first lets quickly review the Equity Markets.

SPX is really in a tight spot. It needs to break higher soon. Will we get a pullback and a surge in commodities?

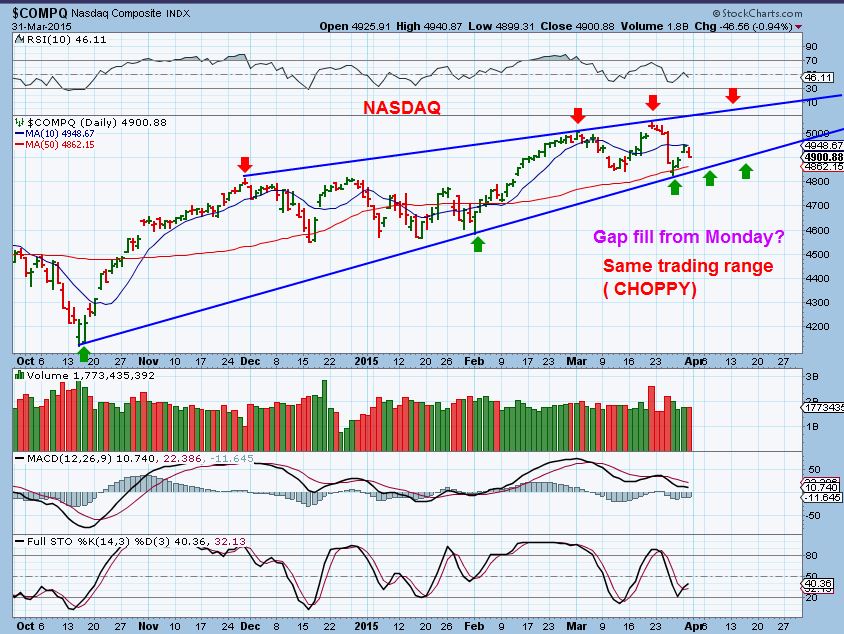

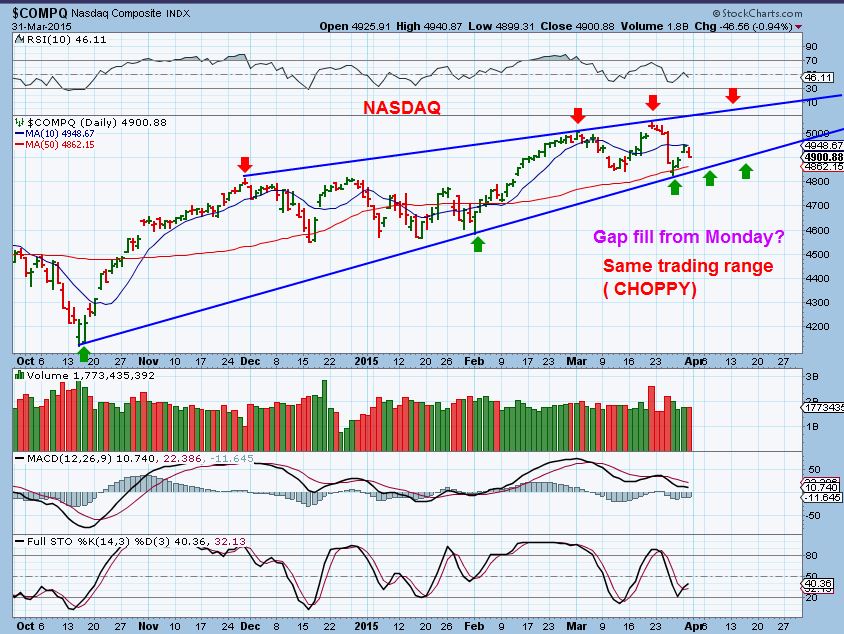

Does the NASDAQ look any different? There certainly was no shortage of break outs in Tech yesterday...

Read MorePrices fluctuate and sometimes get extremely overdone in either direction, but the Energy needs of this planet are not going away. Thats the main focus of this report, but first let me address the reversal in the markets today.

QQQ - I have been pointing out the WEDGE pattern in the NASDAQ, SPX, etc. Today I just want to point out an observation with todays reversal on the 10 sma. It looks like Markets want higher prices again.

The SPX was similar , but I want to point this out on the IWM/IWC before moving on to Energy and Metals mkts...

Read More

Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. - JESSE LIVERMORE

Jesse was a legendary trader in his lifetime. His experiences taught him that even though he was able to made good money trading, he also lost good amounts of money by over-trading. After decades of trading & investing, he offered the above advice, showing that patience can be rare, but also patience can be more rewarding if you know you are correct about a certain set up and patiently wait for it to unfold.

As a trader, I like to find & buy good set ups and sell them in a few days as they play out, but I also have tried to find proper set ups and allow them to play out until they are longer term rewarding. Let me give you a couple of examples of how "Sitting Tight when you know you're right" can pay off.

Read More You may have noticed that yesterday many of the markets across the board started out rising higher, but ended up selling off. Lets take a look and see if it means anything at all...

SPX March 13 - It reversed at resistance.

That in itself doesnt mean too much, but take a look at this ...

Read MoreI cannot believe how many beautiful chart set ups keep popping up for traders in the markets. I've mentioned STEEL stocks, Energy, Tech, and really even some of the Miners have been setting up rather interestingly. Are all systems go? Lets turn to the 38 charts for more information...

SPX- Still wants to run higher

And since the week has ended, here is the NASDAQ WEEKLY CHART...

Read MoreYesterday it seemed like anything China was the place to be. Many Chinese stocks started to really POP, but does that mean we should jump on board and be buyers at this point? Lets look at a few charts ...

FXI- I am looking for a reversal or another gap higher (3 gap play?)

Other Chinese ETFs look similar, this is CHII -

Read MoreThe markets are moving much like I have been mentioning over the past few weeks. Things in OIL have played out as expected , and I believe they will continue to do so. I am seeing some interesting things happening in GOLD & MINERS, I will discus that a bit here, but the weekend report may be quite revealing , since we will see a few more days of trading playing out. Lets just get to the charts...

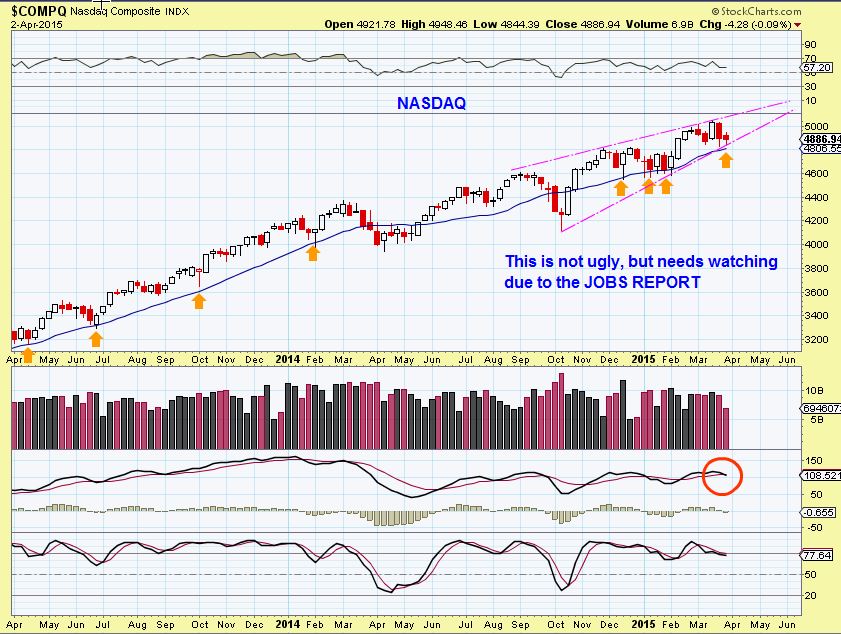

Read MoreI was not so surprised to see the Energy sector doing so well yesterday. We've been expecting that next break higher for a while. I will say that I was surprised to see how quickly the markets shook off that jobs report , however. I mentioned in my weekend report that there were many nice stock set ups, so it was puzzling that the markets looked ready to break down. Well, just like that hypnotic dance forward in a conga line, the buy the dips crowd didnt want to skip a beat...

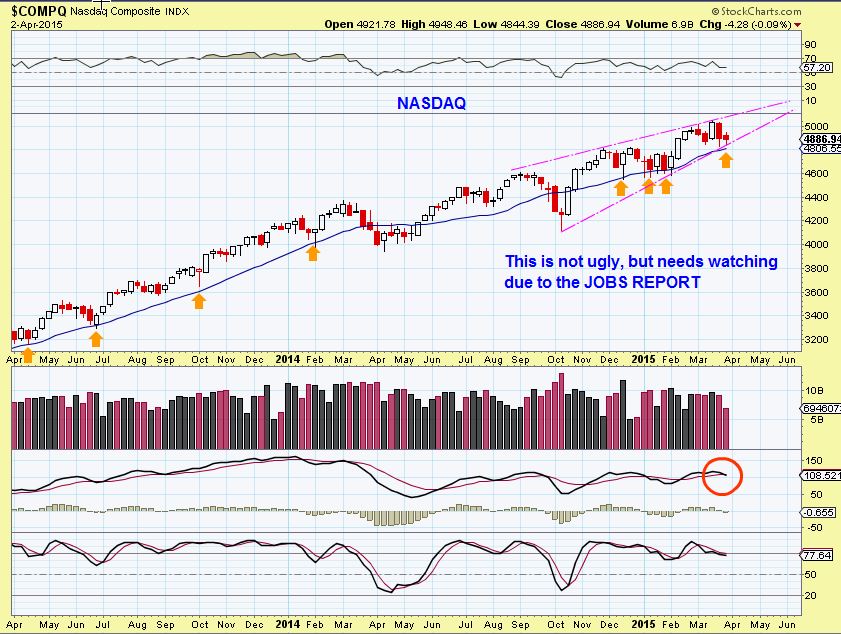

NAZ from my wkend report. I thought a gap down could break this wedge

Yesterday we saw a gap down and then the reversal higher, but I still want to point out this important point ...

Read MoreFridays Jobs Report said a lot, and how the various markets react should be quite interesting. The markets were closed Friday , so what will Monday bring? Check this out...

I'll start with the IBB WEEKLY chart. This isnt overly Bearish at this point, its still above the weekly moving average, but needs monitoring.It was last Spring that Biotechs sold off deeply.

Now lets look at the SPX & the NASDAQ, but first let me explain the possible implicaitons of the negative jobs report that came out Friday ...

Read MoreFriday the stock market is closed , but I have a lot to say after yesterday, so lets check the charts and see whats happening at the end of our trading week...

.

In this chart Yesterday, I had pointed out that the NASDAQ had a gap to fill and support at the wedge, would it hold?

This is the chart from the close Wednesday...

Read More

Scroll to top