Archive for month: March, 2015

It's Wednesday and again the FED seems to be adding uncertainty and volatility to the various markets. Lets look at some charts, not too much has changed since yesterdays report.

QQQ March 16

Here is a different view and how things progressed yesterday, March 17...

Read MoreI want to focus specifically on the subject that was my midday alert Monday, but first a quick market overview.

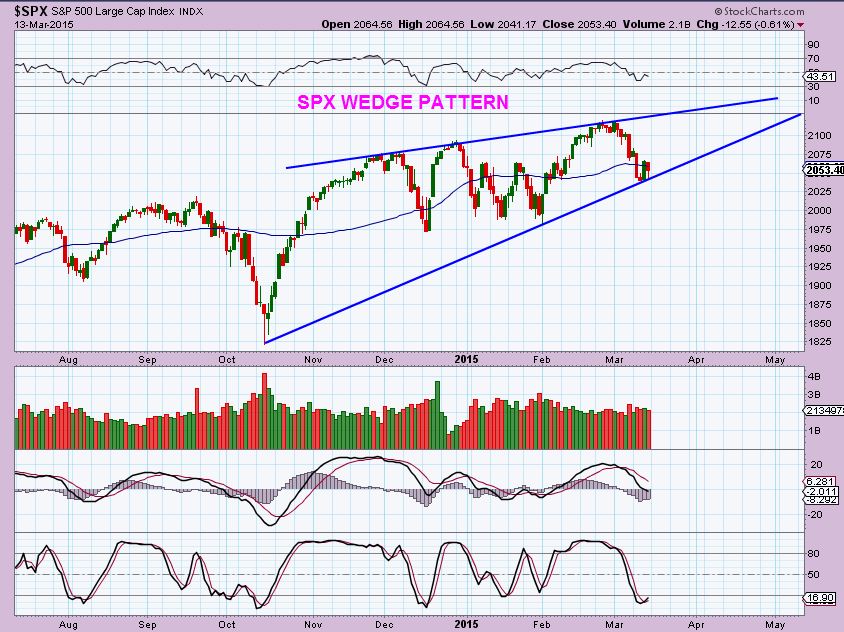

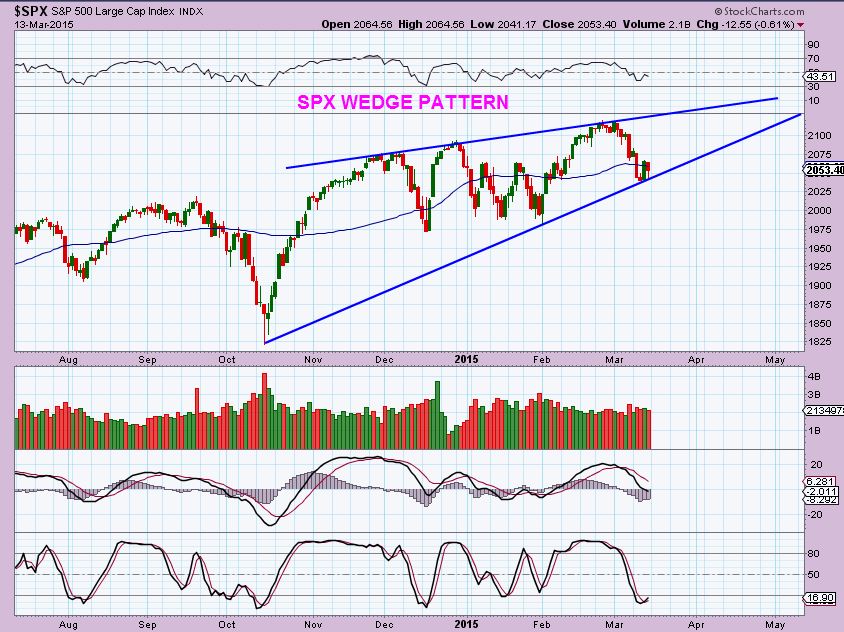

SPX - We looked ready to move higher, and we did, but within a possible wedge pattern.

I took a look at the QQQ's and pointed out this...

Read MoreI have been out most of the day, but when I got back to my desk, I couldnt help but notice something, so I wanted to just quickly post a short update here....

Read MoreLets review some charts and examine what possibly fits next weeks possibilities.

SPX chart from March 11, looking for a buy point

SO where does the SPX stand now?...

Read More Yesterday at 7 a.m. I saw that the futures for the DJIA, SPX, and NASDAQ were green, but I said that I expected them to would sell off and close red for the day. They did. What about now , the futures are Green again pre-market, Are we due for a bounce? Lets look at some charts...

March 9 , QQQ looking for more downside. Notice the yellow dotted line and blue trend line break out

Lets look at the various markets as of yesterday ...

Read MoreA Lesson On Long Strong Base:

I did a report in the past about how much I love being able to trade a well formed base. The report was highlighting LONG tight bases, they can be explosive. They stand out to me because in the past I have had such huge %-Gainers when stocks broke out of them. Do they always work? No. To be honest, I have entered some that also just bounced around and bored me to death, and some have even broken down due to bad earnings or an FDA rejection of their testing, etc . The Idea is that you buy near the supporting lows, so if it drops you get stopped out with small losses,. If it breaks out higher, the upside has huge potential.

Let me show you some examples of trades that I worked on this site before it became a premium site. With the Ebola scare, I noticed that many of the Ebola play stocks had formed good bases. APT, LAKE were 2 that I bought at support in the bases.

APT was stair-stepping higher and the pullbacks were being accumulated. Suddenly ...

Read MoreAs mentioned in the past, there are times when the markets allow us to see clearly the direction they want to head in for a sustained period of time, and at other times it's just not that clear. Often times when the various markets are changing direction, price gets a little choppy. Entering trades during that period can be frustrating too, since even good set ups may work for a day or two , only to fail the next. Unless you are a day trader , then that leads us to this conclusion for traders who want to buy & hold positions for a week or two - Sometimes it's a good time to be trading and at other times it's best to just try to be patient.

Futures are currently higher in the DJIA, SPX, and NASDAQ, is the pullback over?

Yesterday , I was looking for a deeper pullback

Yes, the futures are green, but is it just a bounce? Notice what I wrote on the following chart of the QQQ's...

Read MoreThere are times in the markets when the next short term direction is a little hazy, though the longer term view seems fairly certain. Lets face it, when one is invested , any uncertainty can cause one to get anxious while holding positions, especially if there is any volatility. So what can be done to find peace Of Mind under such circumstances? Lets review the various markets and then answer that question.

QQQ- The 1st target in the Nasdaq was met ( 5000) , and now a drop is likely.

The Nasdaq has plenty of room to drop, even just to "test" the recent break out, but notice the SPX...

Read MoreWe may need a little more information to know the short term direction in various sectors, since the markets all seem to currently be somewhere on Middle Ground. Lets take a look at a few charts and you'll see what I mean.

This was the NASDAQ March 3rd - 1st target met - a possible pullback to test the break out or 50sma

This was the NASDAQ Friday ...

Read MoreI dont always do a Friday report if not much has changed since Thursdays report, but with the release of the jobs number , I did want to cover one thing...

Read More

Scroll to top