What’s The Big Idea?

My weekend report had over40 charts, some for educational purposes and others to point out a few trade set ups. We have been focused on specific sectors and I wanted to focus on what I think could be important at this moment. I’d like to share a small portion of that with you here.

IBB – One area that I’ve been stalking lately is the the Biotech sector. It has been bottoming for over a month and broke out recently. Lets review what we’ve been watching.

IBB March 21= double bottom base

Nice break out (But notice the resistance on the left. Were there buyers there hoping to sell at break even?).

IBB WKLY – Apparently so, sellers may be present, but I expect this to go higher when they are out of the way. Thats a nice base. Support is now near $270-$275, The saying is “Buy the dips , sell the rips”.

.

SO I HAVE BEEN DISCUSSING BIOTECH IN MY REPORTS

.

WTIC April 7 chart – We caught the lows in Oil in February when almost everyone else was Bearish, saying that Oil would drop into the teens. I had a target of $26 or $24, and we made great gains on the first run higher. Some of our energy stocks ran up 100%.

WTIC – After stalling at the 200sma, oil dropped and tested the 50sma area.

WTIC WKLY – Using cycle counts, we’ve been ‘counting’ on our next low to trade. 🙂 I am bullish on Oil.

.

I listed a number of Energy / Oil charts in one of Last weeks report.

.

I wanted to show this WKLY CRB chart.

I also had us trading commodity stocks in February. See X, AKS, CENX, VALE, CLF, SID, FCX, etc. These are some of the stocks that had set up for a low risk / high reward trade.

MARH 4th – After selling out on the way higher, I SAID THAT WE MAY SEE THIS. It may bore you to tears, but it is bullish if we do, so we would buy into this consolidation.

APRIL 5th – We did see that – and – WE WERE BORED TO TEARS!  The reward could be fast approaching, VALE popped 10% on Friday.

The reward could be fast approaching, VALE popped 10% on Friday.

.

Another example of our trades:

CLF – While most were afraid of a weak China killing commodities, the opportunities showed up in the charts. We bought the bullish inverse H&S. What a bargain for CLF, near $1.50

CLF – March 17 and at that point almost $3. Look at the Bigger picture. I expected a possible consolidation that would be bullish too.

CLF – April 6th – We got an up-trending consolidation. I posted this last week.

GOLD & MINERS

..

We bought The Low in Miners in Mid January and added in early February. What an excellent run higher that was. Again, Most were very afraid to trade Miners then. In all honesty, I sold out of my positions by mid-March ( Except for a couple of recently started core positions) and expected a good pull back. The pullback has been a month long consolidation, but it has not been as deep as I expected yet.

So are we seeing The OLD FALSE BREAK OUT TRICK ? Or are Miners ready to make another run similar to the first one before really pulling back?

I have a few ideas in that area, but I must say that many of the Miners stock charts look quite bullish. Lets take a look at a couple in the weekend report.

.-

DRD– Strictly using T/A , this would be a BUY with a close stop. We may see a run higher now, or a false break and a drop to trap bulls, but wither way, I expect higher prices in the long run.

NGD – This is another bullish set up that usually acts like a mid-point consolidation. It ran from $2 to $4, goes sideways and the ‘buy the dip’ crowd waits, and then it runs away again , leaving people behind. Is that happening now? Coming out of a severe Bear Mkt, it is possible.

.

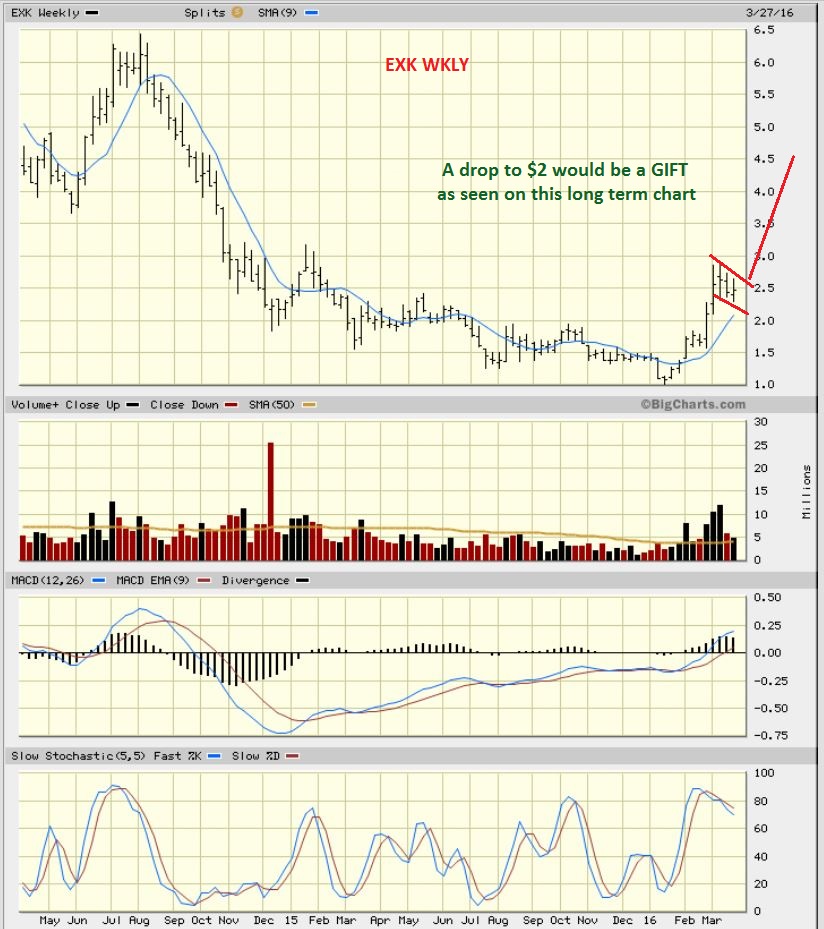

I went on to discuss other Miners and ideas in the weekend report. I deas like this EXK WEEKLY chart were posted last week to show the bigger picture potential, even if we did get a pull back.

EXK didnt drop to $2 , instead it ran higher last week. If they do the Pop & Drop , they still may play the E.W. route with a a-b-c when Gold drops. Use STOPS to lock in gains.

.

CONCLUSION:

2016 has been an excellent time of trading and investing here at Chartfreak. Occasionally we get into a consolidation phase that can be boring, but they lead to the next run higher if conditions remain bullish, and that is what I have been focusing on here at Chartfreak. I have had many of my readers comment that they have paid off there yearly subscription cost with just a few good trades. THAT is rewarding to me and to them. Why not try a 1 month subscription for only $37.95? I am currently seeing things line up that should more than be able to cover the cost of a 1 month subscription.

.

To Sign up here, click and scroll down

.

I Hope you all had a great Friday and weekend, I think this week could be a good one too.

.

Just a heads up, and I’m sure many of you have noticed, but one of our commodities is kicking off earnings today…AA

If we’re looking for a catalyst for a move, this could be a bit of gun powder…or a bomb. I’ll be watching after hours w stop limit orders set on AA and CENX.

Fun stuff. Buying a little this morning, but will have stops set tight. They’re both set up as low risk entries w appropriate position sizing.

Good stuff Fubsy , Thanks! I was looking at that chart for CENX, and I like that pull back so far.

And good to hear from you again, another one of my old friends form the web 🙂

They both are set up nicely. Thanks for the ongoing stream of excellent ideas. I truly appreciate it!

It’s bouncing rt off that 50 dma w a nice gently sloping correction. Hopefully the market will either respond nicely to. AA’s earnings or see past em to an improving landscape for commods.

Okie dokie..in cenx at 6.73. Nice reversal pivot off 50 dma last week.

We’ll see how the market likes AA at 5 pm est. Also holding a couple other of CF’s ideas.

EMES, ERF.

Personally waiting on miners for an IC., PM bulls love to leave the most riders behind, which means i expect but can’t count on a convincing thrust higher in gdx, but if this is the beginning of the next great bull in gold, there will be a chance to buy when it gives it’s first ferocious back kick to the gonads of everyone piling into strength. I have held fsm and ric for some time, and will ride them until parabola in gdx or bankruptcy.

fwiw

Keep an eye on CHK 🙂

Had MCEP on my list this morning, but it ran away before I could get to it….wow. Geez.

LABU Is ready to go too